Maintain a balance of projects producing cash, near term cash and explorations assets and grow the Company’s value and share price by leveraging core cash flows from producing assets to develop resources projects that relate to metals expected to increase in demand and price. This is to be achieved through:

Operating Strategy - Self sufficient

As an operator of a magnetite tailings business in the US, the Company, unlike many of its peers, has an underlying cash flow. The SML Board has committed to ensuring that corporate overheads, required for a listed company, are maintained within this cash flow and that funds raised from any share issues are utilised to progress value accretive projects.

Investment Strategy– Three factor approach

The Company has an investment strategy aimed at adding shareholder value through investment in:

- Metal projects that are expected to benefit from significant demand and associated price increases (such as Copper and Tin).

- Projects that will develop additional income streams (short & medium term : Leigh Creek Copper Mine, longer term : Redmoor Tin and Tungsten Mine) that will diversify dependency on the Company’s magnetite tailings business.

- Critical Resources recognized as strategically important (such as Tungsten),

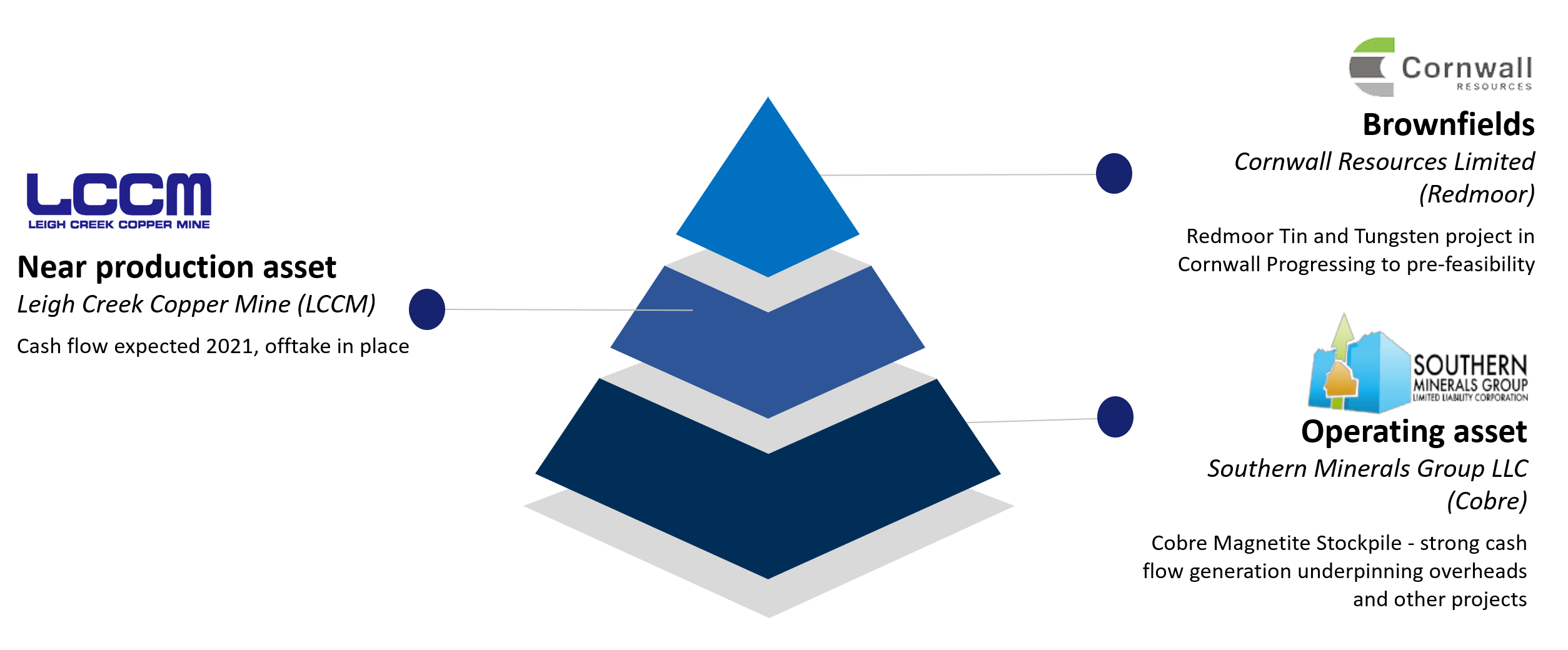

This three factor approach has been reflected in the Company’s current project portfolio, shown below